Ethereum underwent an enormous community improve referred to as the merge which proponents say will make transactions far more power environment friendly. Following the merge, ether costs have dropped following an enormous run up forward of the occasion.

Jakub Porzycki | Nurphoto | Getty Photos

Ether has fallen greater than bitcoin for the reason that cryptocurrency’s underlying know-how, the Ethereum community, underwent an enormous improve referred to as the merge.

Ethereum is a blockchain technology that successfully permits builders to construct apps on prime of it. Ether is the native cryptocurrency that runs on Ethereum.

associated investing information

The merge is an improve to Ethereum that modifications the validation mechanism for transactions from a proof-of-work method to proof-of-stake. Proponents say this can make validating transactions on Ethereum far more power environment friendly and has been eagerly-anticipated by the crypto group.

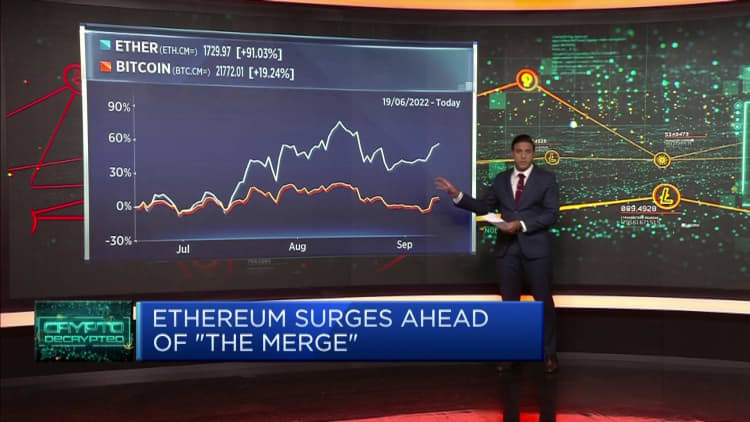

Regardless of the improve taking place efficiently, ether has fallen greater than bitcoin.

Since Sept. 15, the date the merge was accomplished, to round 4:30 a.m ET on Tuesday, ether is down round 15%. Bitcoin has dropped round 3% in the identical interval.

Forward of the community improve, the price of ether roughly doubled from the lows of the year in June, far outpacing bitcoin’s good points.

Vijay Ayyar, vp of company growth and worldwide at crypto trade Luno, stated that the merge was already “priced in” for ether and the “precise occasion was a ‘promote the information’ scenario.”

Merchants are additionally shifting investments from ether and different different digital cash again into bitcoin, in accordance with Ayyar, “for the reason that expectation is that Bitcoin will outperform for a couple of months from right here on.”

Traders are additionally questioning whether or not the regulatory standing of ether could change after the merge after U.S. Securities and Alternate Fee Chair Gary Gensler indicated final week that cryptocurrencies that work on the proof-of-stake mannequin, which applies to Ethereum, might be classed as a safety. That will carry it below the purview of the regulators.

Gensler’s, whose feedback have been reported by a number of news outlets, didn’t title ether particularly. The proof-of-stake mannequin includes buyers “staking” or locking up their ether and incomes returns for doing so.

“For Ethereum, there may be one other concern: PoS (proof-of-stake) crypto could fall below SEC’s scrutiny,” stated Yuya Hasegawa, crypto market analyst at Japanese crypto trade Bitbank.

Fee hikes nonetheless in focus

Crypto buyers are additionally on edge forward of an expected interest rate rise from the U.S. Federal Reserve this week.

Central banks world wide have been elevating rates of interest to cope with rampant inflation. However that has harm danger belongings corresponding to shares. Cryptocurrencies have been intently correlated with U.S. inventory markets, specifically the tech-heavy Nasdaq. With shares remaining below strain, crypto has additionally felt the warmth.

Inflation within the U.S. in August got here in larger than anticipated, which hit shares and crypto.

“From a macro perspective as effectively, inflation did are available in larger, and therefore induced a unload throughout all markets, however ethereum and altcoins did unload tougher, given they’re alongside the extra dangerous a part of the crypto spectrum,” Ayyar stated.

Bitcoin has been buying and selling in a spread of about $18,000 to $25,000 since June, a degree at which buyers are shopping for in, in accordance with Ayyar.

However any “change within the macro atmosphere by way of inflation of rate of interest surprises, is unquestionably trigger for concern,” he stated, including that if bitcoin falls beneath $18,000, the cryptocurrency may take a look at ranges as little as $14,000.