Key Takeaways

- Ethereum’s improve to Proof-of-Stake has sparked considerations over the community’s resiliency towards 51% assaults.

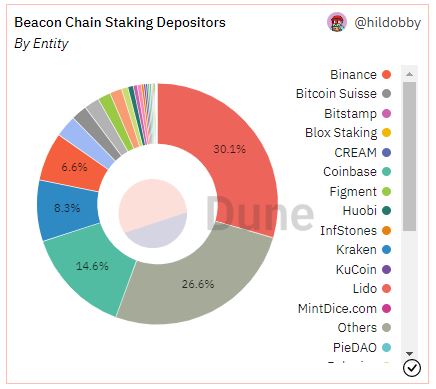

- The highest 4 staking entities account for 59.6% of the entire staked ETH.

- Nevertheless, user-activated delicate forks (UASFs) make sure that unhealthy actors can not take over the community, irrespective of how huge their stake.

Share this text

Proof-of-Stake critics have sounded the alarm on Ethereum’s new Proof-of-Stake consensus mechanism, claiming it makes the community vulnerable to hostile community takeovers. Nevertheless, Ethereum’s new system comprises a failsafe to mitigate this threat and permits customers to burn the funds of any attacker making an attempt to take management of the blockchain.

Ethereum’s Vulnerability to 51% Assaults

Ethereum’s current change away from Proof-of-Work has raised questions concerning the community’s potential to fend off assaults.

On September 15, Ethereum efficiently upgraded its consensus mechanism to Proof-of-Stake. Amongst different issues, the occasion, now identified within the crypto neighborhood because the “Merge,” handed block manufacturing duties from miners to validators. Opposite to miners, which use specialised {hardware}, validators solely have to stake 32 ETH to realize the appropriate to course of transactions.

Nevertheless, some crypto neighborhood members have been fast to level out that the majority of Ethereum’s validating energy is now within the palms of just some entities. Knowledge from Dune Analytics indicate that Lido, Coinbase, Kraken, and Binance account for 59.6% of the entire staked ETH market share.

This excessive focus of staking energy has raised considerations that Ethereum could also be weak to 51% attacks—a time period used within the crypto house to designate a hostile takeover of a blockchain by an entity (or group of entities) accountable for the vast majority of block processing energy. In different phrases, the fear is that giant staking entities might collude to rewrite elements of Ethereum’s blockchain, change the ordering of latest transactions, or censor particular blocks.

The opportunity of a 51% assault grew to become notably salient after the U.S. authorities’s ban on Twister Money. On August 8, the U.S. Treasury Division added privateness protocol Twister Money to its sanctions listing, arguing cybercriminals used the crypto challenge for money-laundering functions. Coinbase, Kraken, Circle, and different centralized entities shortly complied with the sanctions and blacklisted Ethereum addresses related to Twister Money. So what would stop these firms from utilizing their staking energy to censor transactions on Ethereum’s base layer if the Treasury ordered them to?

As Ethereum creator Vitalik Buterin and different builders have argued, the community nonetheless has an ace up its sleeve: the potential for implementing user-activated delicate forks (UASFs).

What Is a UASF?

A UASF is a mechanism by which a blockchain’s nodes activate a delicate fork (a community replace) with no need to acquire the standard help from the chain’s block producers (miners in Proof-of-Work, validators in Proof-of-Stake).

What makes the process extraordinary is that delicate forks are usually triggered by block producers; UASFs, in impact, wrest management of the blockchain from them and quickly hand it over to nodes (which might be operated by anybody). In different phrases, a blockchain neighborhood has the choice of updating a community’s software program no matter what miners or validators need.

The time period is usually related to Bitcoin, which notably triggered a UASF in 2017 to drive the activation of the controversial SegWit improve. However Ethereum’s Proof-of-Stake mechanism was designed to allow minority-led UASFs particularly to battle towards 51% assaults. Ought to an attacker try to take management of the blockchain, the Ethereum neighborhood might merely set off a UASF and destroy the whole thing of the malicious actor’s staked ETH—decreasing their validating energy to zero.

In actual fact, Buterin has claimed that UASFs make Proof-of-Stake much more proof against 51% assaults than Proof-of-Work. In Proof-of-Work, attackers merely want to amass the vast majority of the hashrate to take over the blockchain; doing so is dear, however there isn’t any different penalty moreover that. Bitcoin can change its algorithm to render a number of the attacker’s mining energy ineffective, however it might solely achieve this as soon as. However, Proof-of-Stake mechanisms can slash an attacker’s funds as many occasions as vital by means of UASFs. In Buterin’s phrases:

“Attacking the chain the primary time will value the attacker many tens of millions of {dollars}, and the neighborhood will probably be again on their ft inside days. Attacking the chain the second time will nonetheless value the attacker many tens of millions of {dollars}, as they would want to purchase new cash to exchange their previous cash that had been burned. And the third time will… value much more tens of millions of {dollars}. The sport could be very uneven, and never within the attacker’s favor.”

Slashing Is the Nuclear Choice

When requested whether or not Coinbase would ever (if requested by the Treasury) use its validating energy to censor transactions on Ethereum, Coinbase CEO Brian Armstrong stated that he would moderately “deal with the larger image” and shut down the alternate’s staking service. Whereas there’s little motive to doubt the sincerity of his reply, the potential for a UASF possible performed a task within the equation. Coinbase at the moment has over 2,023,968 ETH (roughly $2.7 billion at in the present day’s costs) staked on mainnet. The alternate’s total stack may very well be slashed if it tried censoring Ethereum transactions.

It’s vital to notice that slashing is just not Ethereum’s solely possibility in case of a malicious takeover. The Ethereum Basis has indicated that Proof-of-Stake additionally allows trustworthy validators (that means validators not making an attempt to assault the community) to “maintain constructing on a minority chain and ignore the attacker’s fork whereas encouraging apps, exchanges, and swimming pools to do the identical.” The attacker would maintain their ETH stake, however discover themselves locked out of the related community going ahead.

Lastly, it’s value mentioning that Ethereum’s staking market isn’t fairly as centralized as it might initially appear. Lido, which at the moment processes 30.1% of the entire staked ETH market, is a decentralized protocol that makes use of over 29 totally different staking service suppliers. These particular person validators are those accountable for the staked ETH—not Lido itself. Thus, collusion between main staking entities can be way more tough to arrange than it could initially seem.

Disclaimer: On the time of writing, the creator of this piece owned BTC, ETH, and a number of other different cryptocurrencies.