- Ethereum worth’s early week rebound stalls at $1,340.

- Justin Bons, the founding father of Cyber Capital, reckons that no ETH transaction has been stopped or censored because the Merge.

- A break under the 50-day SMA on the eight-hour may drag ETH worth nearer to validating a falling triangle breakout.

- Ethereum provide in loss rises to 52 million, hinting at a bullish worth transfer.

Ethereum worth appears comparatively unchanged on Tuesday after bulls propelled it to $1,340 on Monday. Though the pioneer good contracts token managed to climb above the 50-day SMA (Easy Transferring Common), crimson, at $1,315, its momentum light earlier than confirming assist above $1,340.

Ethereum worth is in a dilemma as a result of buying and selling under the 50-day SMA might validate a falling triangle sample. Conversely, the second-largest cryptocurrency may prolong its early week bullish breakout to tag $1,521 and presumably shut the hole to $2,000.

No Ethereum transactions have been stopped

Ethereum customers like Justin Bons, the founding father of Cyber Capital, are taking a stand towards allegations that the PoS (proof-of-stake) community is liable to censorship from exterior authorities following the Merge software program replace in September.

Bons reckons that claims censorship is occuring made by “sure Bitcoiners” aren’t in good religion – and that not a single ETH transaction has up to now been stopped as a consequence of OFAC (Workplace of International Belongings Management) sanctions.

“Even with 50% OFAC compliance, a non-compliant ETH TX will likely be confirmed inside 30 sec! In comparison with BTC’s extra variable 10min!” Bons defined to his followers on Twitter.

“Because of this a really small minority of validators/miners can counter such censorship over each ETH & BTC! Simply lower than 1% can stop censorship,” the fund supervisor continued.

The state of the Ethereum community has continued to enhance because the Merge. Final week, FXStreet reported that ETH had become nondeflationary, so the worth might quickly begin trending to the upside.

Ethereum worth dangers sliding 15% under the breakout level

If validated, a falling triangle sample on the eight-hour chart may decree a 15.22% decline in Ethereum worth. Nevertheless, this validation won’t come simple, preserving in thoughts assist on the 50-day SMA.

The RSI (Relative Power Index) exhibits that sellers are preventing to regain management, however bulls appear adamant. Merchants on the lookout for quick positions should anticipate ETH to slide under the shifting common earlier than triggering their orders.

ETH/USD eight-hour chart

Then again, the 15.22% triangle breakout worth goal will solely be activated if Ethereum worth cracks under the horizontal (x-axis) assist at $1,250. Nonetheless, such a transfer may see ETH revisit downhill ranges at $1,057 and $1,000, respectively, earlier than rebounding to regain the bottom to $2,000.

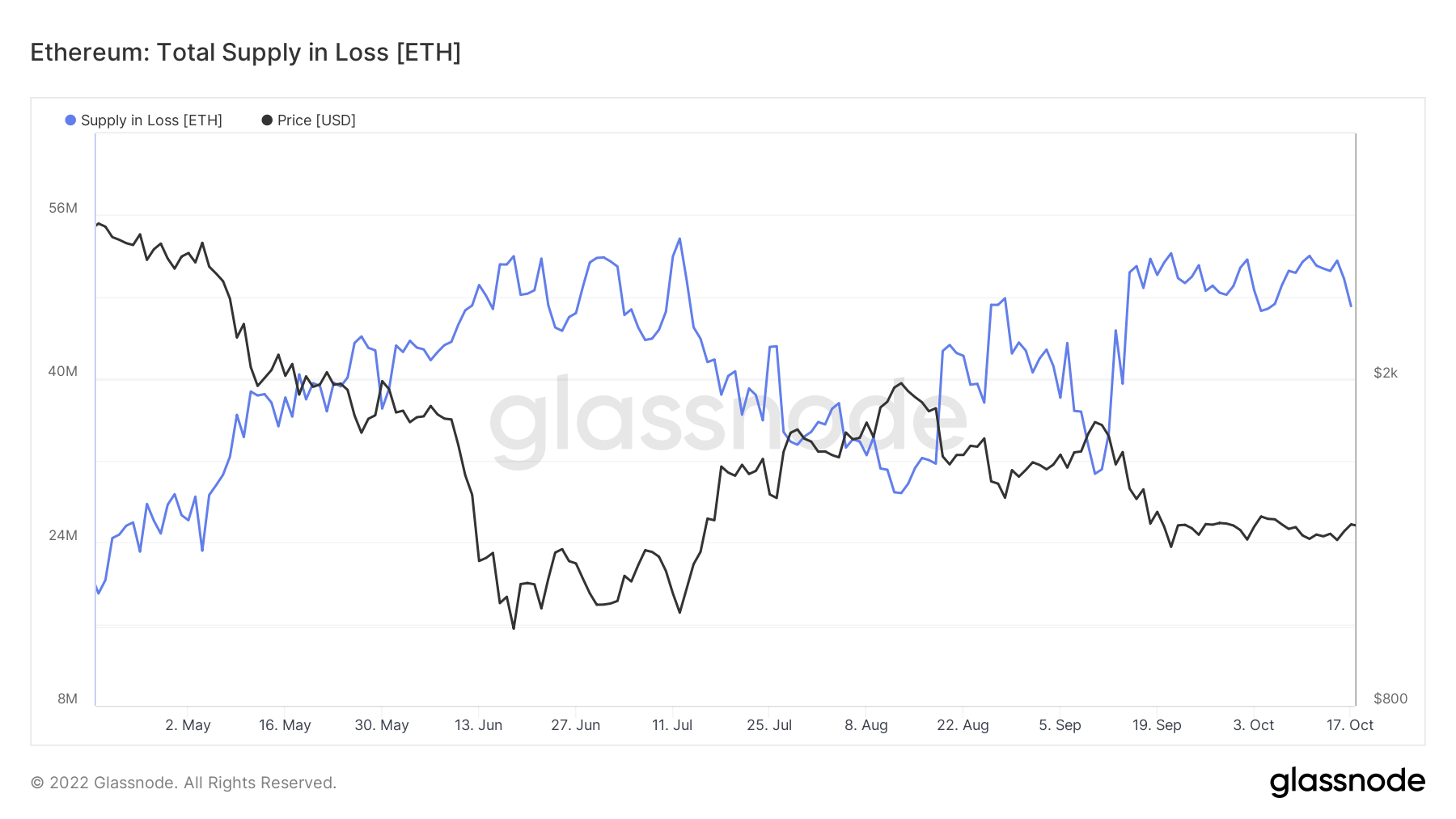

Ethereum Provide In Loss

The overall provide of ETH tokens in loss rallied to roughly 52 million from the 30 million recorded on September 30. In accordance with Glassnode, this on-chain metric tracks the variety of tokens whose worth was increased than the present worth on the time they final moved.

As noticed from the chart, Ethereum worth is negatively correlated with the overall provide in loss. In different phrases, as provide in loss will increase, Ethereum worth drops. Subsequently, a bullish transfer may very well be awaiting Ethereum price if this on-chain metric extends the continued pullback from its four-month excessive.

Ethereum worth stays certain to this vary with no directional bias [Video]

from Ethereum – My Blog https://ift.tt/mK4rtxc

via IFTTT