- Since FTX’s collapse, there was a rise in ETH accumulation

- As most HODLers fail to notice revenue, quick merchants look like accumulating

As the worth of main altcoin Ethereum [ETH] lingered above the $1,200 psychological assist stage, knowledge from Santiment revealed that sharks and whales have ramped up their ETH holdings within the final 13 days.

#Ethereum is limboing simply above the $1,200 psychological assist stage, and is down a modest -3.3% previously week. Sharks & whales, in the meantime, have quickly added $ETH to their baggage, rising their holdings by 3.52% in simply the previous 12 days. https://t.co/dLz52ovfTs pic.twitter.com/fTrwdn8Ku0

— Santiment (@santimentfeed) November 18, 2022

Learn Ethereum’s [ETH] price prediction 2023-2024

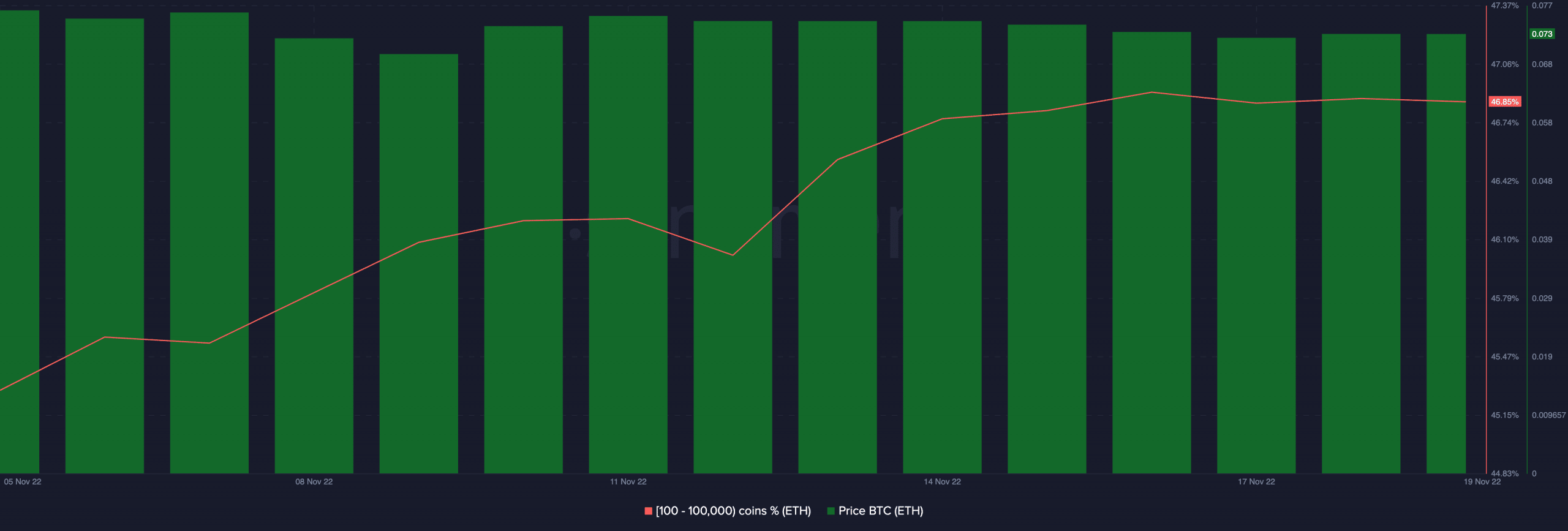

ETH witnessed a 4% value drop within the final seven days. Nevertheless, in keeping with the on-chain analytics platform, ETH addresses that maintain 100 to 100,000 ETH grew their holdings by 3.4% within the final 13 days.

For context, 13 days in the past, Binance co-founder and CEO Changpeng Zhao made the primary tweet about FTX that cascaded into the change’s eventual collapse. Subsequently, ETH sharks and whales launched into an accumulation rally as the overall cryptocurrency market plummeted.

Per knowledge from Santiment, this cohort of ETH holders at present held their largest share of ETH’s provide since July 2021 – 46.85% at press time.

Ethereum accumulation continues to climb

Though ETH traded on the value stage final seen in June, on-chain knowledge revealed that HODLers have more and more amassed the main alt since 6 November.

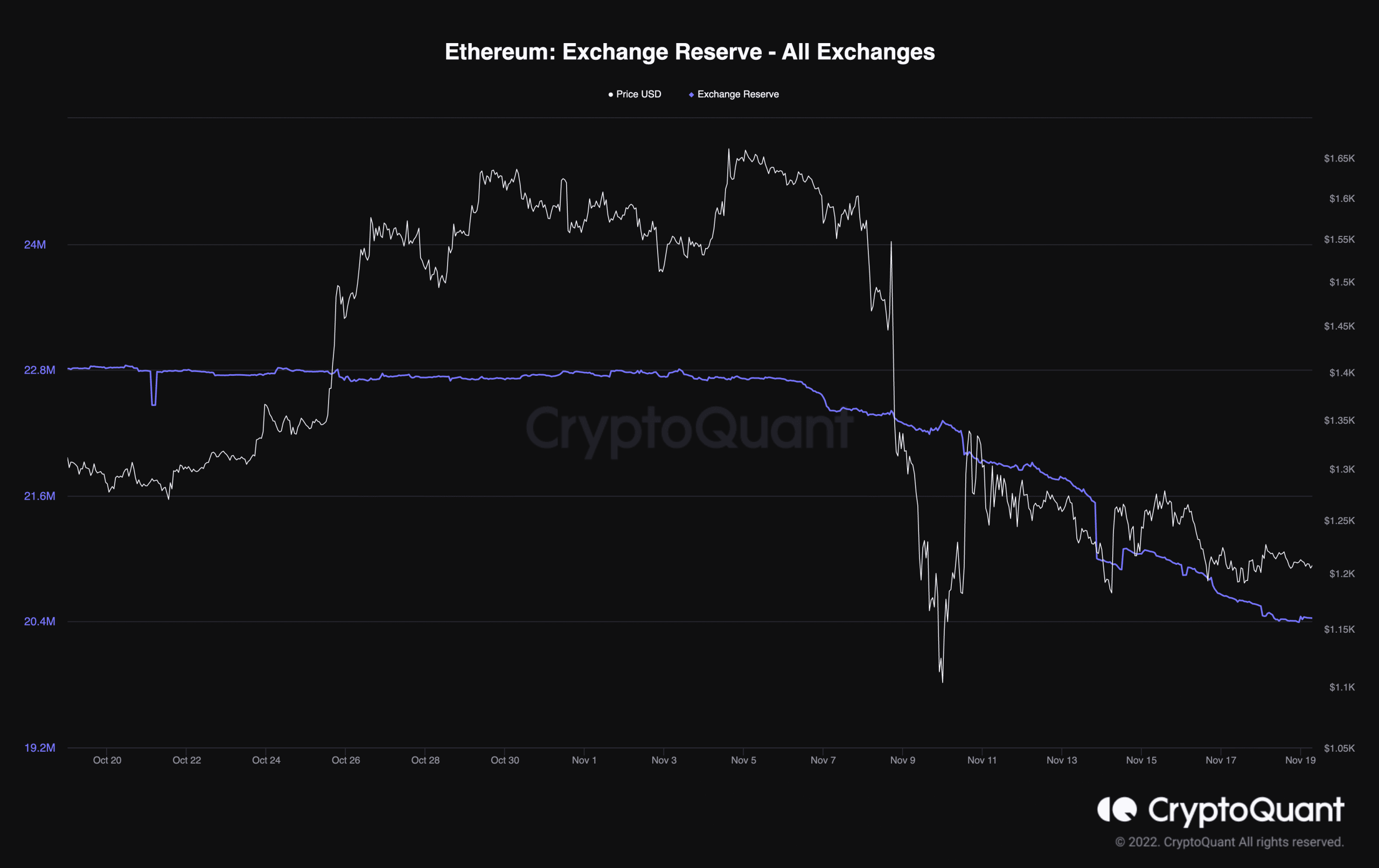

Moreover, knowledge from CryptoQuant confirmed a constant decline within the coin’s change reserve. Up to now two weeks, the quantity of ETH on exchanges declined by 10% and sat at 20.33 million at press time.

This was a sign that fewer ETH sell-offs have taken place since FTX’s collapse, and extra buyers have purchased than bought since then.

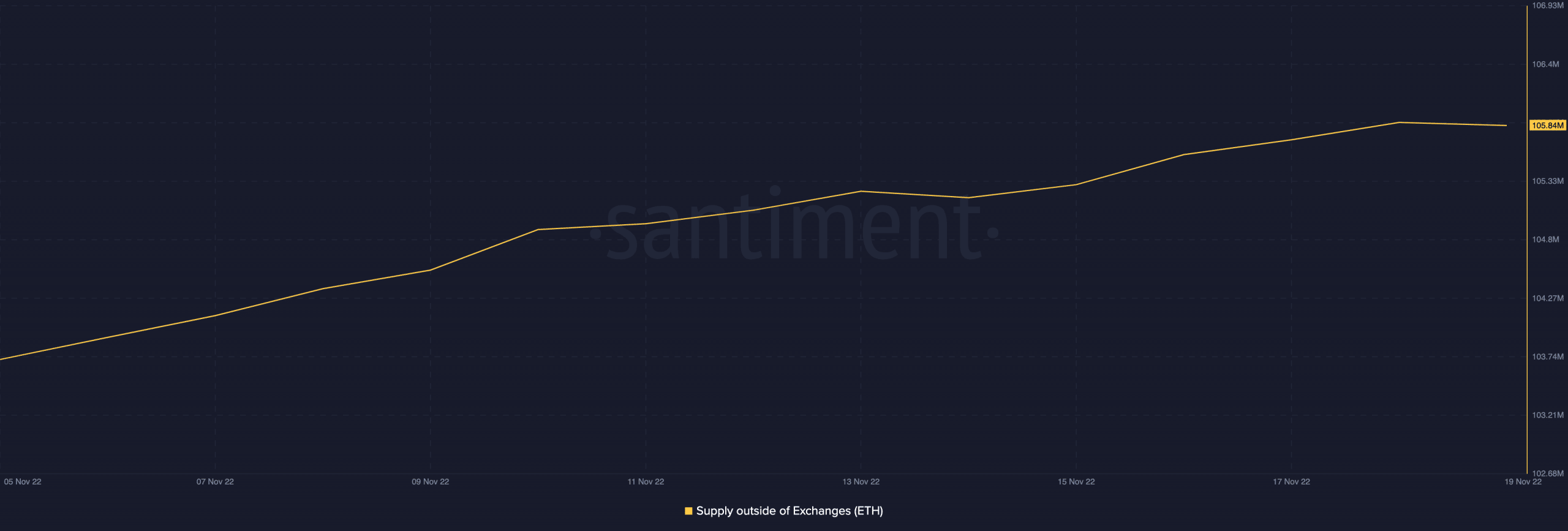

This place was additional corroborated by the expansion in ETH’s provide exterior of exchanges throughout the similar interval. As per knowledge from Santiment, the alt’s provide exterior exchanges went up by 2% since 6 November.

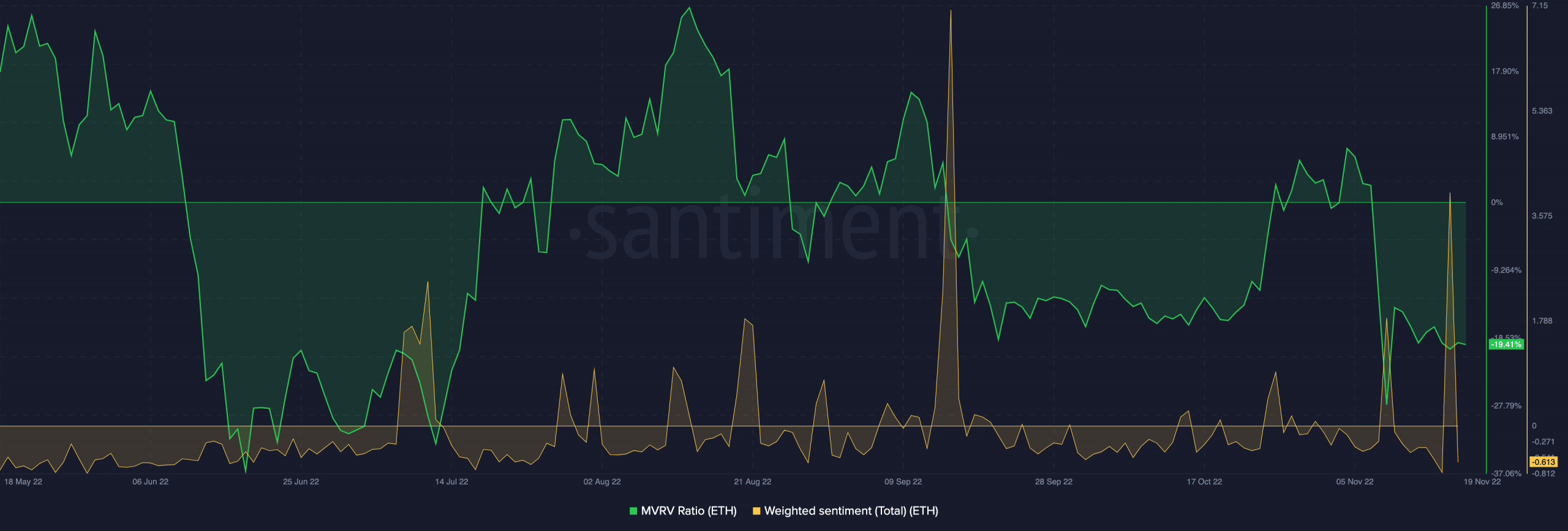

Nevertheless, as uncertainty and FUD trailed the overall cryptocurrency market following FTX’s collapse, buyers’ sentiment towards ETH remained principally detrimental and sat at -0.613 at press time.

As well as, most ETH holders held on to their tokens at a loss since 6 November, knowledge from Santiment revealed. The Market Worth to Realized Worth (MVRV) ratio at press time was detrimental -19.41%.

If most holders have seen losses on their investments since 6 November, why the continued accumulation? A take a look at ETH’s funding charges can clarify this.

Since 6 November, ETH’s funding charges have been primarily detrimental. This meant that the ETH market was flooded by quick merchants who amassed in expectation of an extra value decline.

from Ethereum – My Blog https://ift.tt/Ab7vEFV

via IFTTT